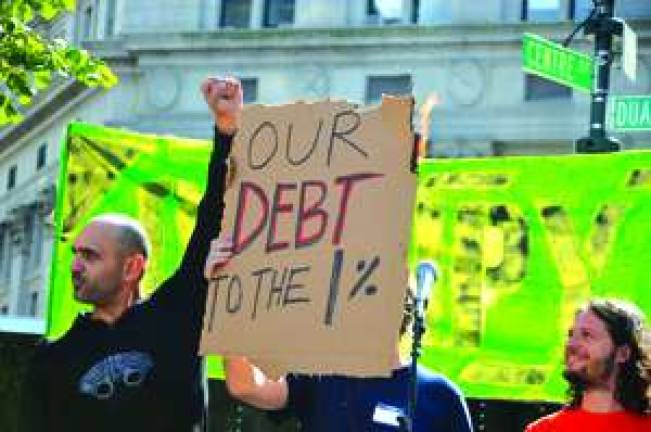

Rolling Jubilee Kicks Off Occupy Fundraiser

An offshoot of Occupy Wall Street is raising money to help alleviate consumer debt. By Caroline Lewis "Whoa, did you see that?" asked Annie Spencer, a professor at Hunter College and a member of the Occupy group Strike Debt. "The live ticker on the Rolling Jubilee website just crossed $200,000 being raised." That was enough to purchase and abolish more than $4 million of debt. It was hours before "The People's Bailout," a live fundraising extravaganza that would kick off the Rolling Jubilee at Le Poisson Rouge in the West Village last Thursday, with help from a slew of comedians and alternative music icons. Thanks, in part, to some unlikely praise from mainstream financial commentators, Strike Debt had already far surpassed their initial goal of raising $50,000. The Rolling Jubilee is a project designed to put Occupiers in the same speculative secondary debt market as professional debt collectors. They will buy debt from banks for pennies on the dollar, but instead of collecting it, abolish it. By Monday, the ticker on the group's website counted more than $350,000 in donations, all of which will go toward reducing the amount owed by some unsuspecting debt-strapped Americans. Slate's Matthew Yglesias briefly wonders, "Why is this a better idea than just giving money to poor people?" before admitting that "almost all charitable undertakings are organized around some kind of gimmick." "We don't like the idea of framing the debtor as someone who needs charity," said Spencer, whose red felt square pinned to her clothing identified her as a member of the movement. "The reality is that three quarters of Americans are in debt of some kind, and increasing numbers of people go into debt for meeting basic needs." Praises for the Rolling Jubilee have rightly been qualified by the observation that this endeavor probably won't make a dent in America's $11 trillion of debt. In fact, the group can't even promise to erase an entire family's debt. "This first debt purchase of over $100,000 of medical debt [constitutes] roughly 80 different people," said Thomas Gokey, who helped execute the group's successful test run. That's because debt is purchased in bundles of defaulted accounts from banks for a fraction of what is owed. The professionals then aggressively seek payment for the full amount from individual debtors. Those in the red don't have to pay back much for debt collectors to turn a profit. So what has this foray into the debt market revealed so far? For one thing, there's a lot more than money at stake. "You're not just buying their debt," said Gokey of the accounts purchased. "You're buying their social security number." The social security number comes with the debtor's last known address and a handful of other information. "It's not a lot in the context of debt collection, because they're not getting any of the documentation that would support their claim that this is how much is owed and it's for this account and it's with this company," said Susan Chin, a staff attorney with the Neighborhood Economic Development Advocacy Project (NEDAP). Chin said debtors are often unaware that they can request verification on claims from debt collectors, and that collectors must stop seeking payment on accounts that cannot be verified. "In general, there's not a lot of oversight right now of the debt buyer industry," Chin said. This may change starting next year. Last month, the Consumer Financial Protection Bureau announced plans to police debt collection agencies starting in January 2013. Some have pointed out the peculiarities of the debt market as limitations of the Rolling Jubilee. For instance, certain kinds of debt-such as mortgages and student debt-are more difficult to abolish due to government protections. The group's website counters, "These peculiarities are part of the scandal that we are trying to highlight."